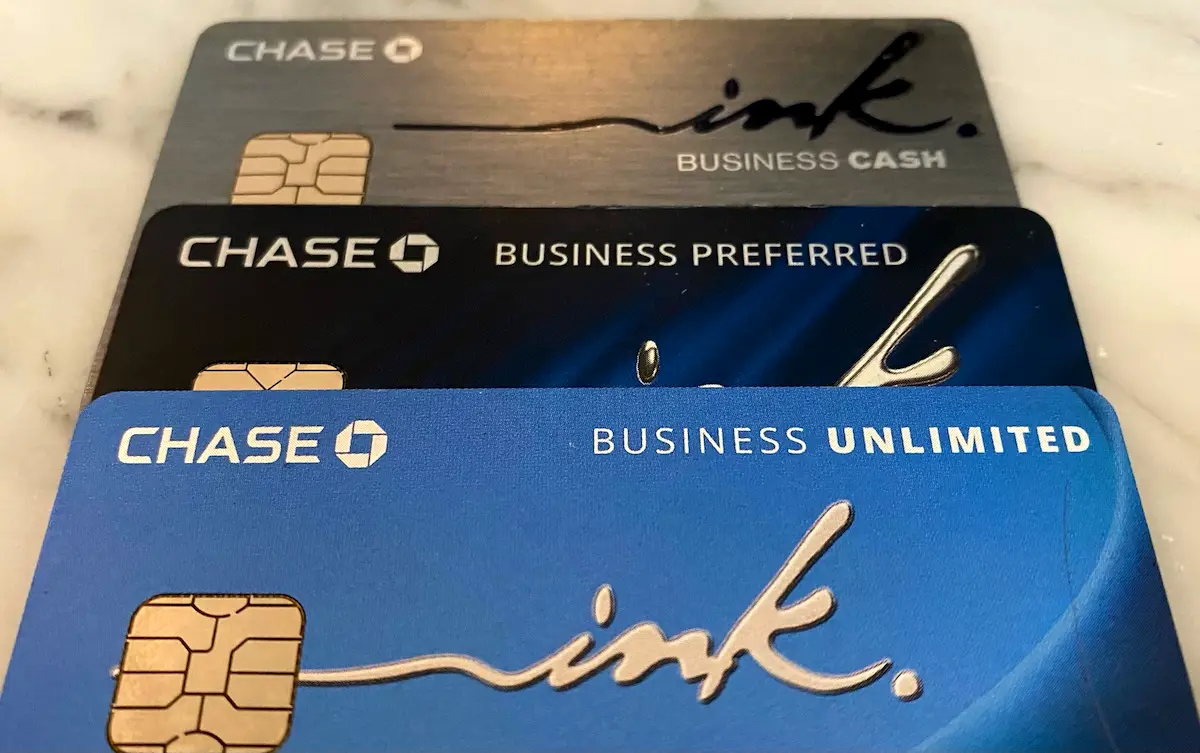

Chase Ink Business Preferred Credit Card Review

Introduction

Welcome to our comprehensive review of the Chase Ink Business Preferred Credit Card! If you’re a business owner looking for a credit card that offers great rewards, travel benefits, and additional perks, then you’re in the right place. In this article, we’ll delve into the features, benefits, fees, and application process of the Chase Ink Business Preferred Credit Card, so you can make an informed decision for your business.

The Chase Ink Business Preferred Credit Card is a popular choice among small business owners and entrepreneurs. It not only offers a generous sign-up bonus but also provides excellent rewards for everyday business expenses. With its robust travel benefits, this card is particularly appealing for those who frequently travel for work or leisure.

Whether you’re looking to rack up points to redeem for travel, earn cash back on business expenses, or access exclusive perks and benefits, the Chase Ink Business Preferred Credit Card has a lot to offer. Let’s dive in and explore the card in more detail.

Overview of Chase Ink Business Preferred Credit Card

The Chase Ink Business Preferred Credit Card is designed specifically for small businesses and offers a wide range of benefits and rewards. It is a versatile credit card that can help businesses save money and earn valuable rewards on their everyday expenses.

One of the highlights of the Chase Ink Business Preferred Credit Card is its generous sign-up bonus. Upon meeting the minimum spending requirement within the first few months of card membership, cardholders can earn a substantial amount of bonus points. These points can be redeemed for travel, cash back, or other rewards, providing businesses with a great opportunity to kick-start their rewards earning journey.

In terms of earning rewards, the Chase Ink Business Preferred Credit Card offers a competitive rewards program. Cardholders earn bonus points in several categories, including travel, advertising purchases, and shipping expenses. This makes it an ideal choice for businesses that spend a significant amount on these categories. Additionally, all other purchases made with the card earn a base rate of rewards points, allowing businesses to earn rewards on all their expenses.

When it comes to redeeming rewards, the Chase Ink Business Preferred Credit Card provides multiple options. Cardholders have the flexibility to redeem their points for statement credits, travel bookings, gift cards, or transfer them to participating frequent flyer and hotel loyalty programs. This versatility ensures that businesses can use their rewards in a way that best suits their needs.

The Chase Ink Business Preferred Credit Card also offers a host of valuable travel benefits. Cardholders enjoy perks such as trip cancellation and interruption insurance, rental car insurance, and baggage delay insurance. For business travelers, these benefits can provide peace of mind and help save money on travel-related expenses.

Furthermore, the Chase Ink Business Preferred Credit Card provides additional perks, such as purchase protection and extended warranty coverage. These benefits can be particularly advantageous for businesses that make frequent purchases and want added protection.

While the Chase Ink Business Preferred Credit Card offers many benefits, it’s important to be aware of its associated fees and potential drawbacks. There are annual fees and foreign transaction fees to consider. Additionally, the card may have certain eligibility requirements which could limit access for some businesses.

In the next sections of this review, we will delve deeper into the sign-up bonus, earning rewards, redeeming rewards, travel benefits, additional perks, fees, and drawbacks of the Chase Ink Business Preferred Credit Card. So, let’s continue exploring the card and all it has to offer!

Sign-up Bonus

The sign-up bonus offered by the Chase Ink Business Preferred Credit Card is one of its most attractive features. New cardholders have the opportunity to earn a substantial amount of bonus points after meeting the minimum spending requirement.

The exact details of the sign-up bonus can vary, so it’s essential to check the current offer at the time of applying. Typically, the bonus points are awarded once you spend a certain amount on purchases within the first few months of card membership.

These bonus points can be incredibly valuable and can be redeemed for various rewards, including travel, cash back, or gift cards. If your business has significant expenses that can be charged to the credit card during the initial months, meeting the minimum spending requirement and earning the sign-up bonus can be easily attainable.

It’s worth noting that the sign-up bonus can be a significant boost to your rewards earnings right from the start. Whether you’re planning to redeem the points for a dream vacation, use them towards business expenses, or simply accumulate rewards for future use, the sign-up bonus sets the foundation for your rewards journey.

Businesses that regularly incur high expenses, such as advertising or travel-related costs, may find it easier to meet the minimum spending requirement for the sign-up bonus. However, it’s important to evaluate your business’s spending patterns and ensure that meeting the requirement won’t lead to unnecessary or excessive spending.

Remember that the sign-up bonus is a one-time offer, and it’s crucial to take advantage of it within the specified timeframe. Additionally, it’s essential to read and understand the terms and conditions associated with the sign-up bonus, including any eligibility requirements and restrictions.

In summary, the sign-up bonus of the Chase Ink Business Preferred Credit Card can provide a significant boost to your rewards earning potential. By meeting the minimum spending requirement within the specified timeframe, you can earn valuable bonus points that can be redeemed for travel, cash back, or other rewards options. Make sure to consider your business’s spending patterns and evaluate whether meeting the spending requirement is feasible before applying for the card.

Earning Rewards

The Chase Ink Business Preferred Credit Card offers a competitive rewards program that allows cardholders to earn valuable points on their business expenses. With a focus on key spending categories, this credit card provides businesses with an opportunity to accumulate rewards quickly.

One of the primary categories where cardholders can earn bonus points is travel. Every dollar spent on travel-related expenses, including flights, hotels, car rentals, and more, earns extra points. This makes the Chase Ink Business Preferred Credit Card an ideal choice for businesses that frequently travel for work or have significant travel expenses.

In addition to travel, the card offers bonus points for advertising purchases. Expenses incurred on social media ads, search engine optimization, and other advertising platforms can help businesses earn rewards faster. This is a valuable feature for businesses that invest heavily in marketing and advertising efforts.

Furthermore, purchases made at shipping providers, such as UPS, FedEx, and USPS, also earn bonus points. For businesses that rely heavily on shipping products or sending out packages to customers, this rewards category can provide significant value.

Even for expenses that don’t fall into these bonus categories, the Chase Ink Business Preferred Credit Card still offers a base rate of rewards points. This means that every dollar spent on everyday business expenses, such as office supplies, utilities, and equipment, will still earn rewards, albeit at a lower rate.

It’s important to note that the bonus categories have spending caps. Once you reach the cap, the bonus rewards rate reverts to the base rate. It’s crucial to keep track of your spending and be mindful of these limits to maximize your rewards earnings.

Overall, the Chase Ink Business Preferred Credit Card provides businesses with an opportunity to earn points on a wide range of expenses. Whether it’s travel, advertising, or shipping, this credit card offers bonus categories that align with typical business expenditures. By consistently using the card for these purchases, businesses can accumulate rewards quickly and maximize their benefits.

Redeeming Rewards

One of the most exciting aspects of the Chase Ink Business Preferred Credit Card is the flexibility it offers when it comes to redeeming your hard-earned rewards. The card provides various options for redeeming your points, allowing you to choose the option that best suits your business’s needs.

One popular redemption option is the ability to use your points for travel. The Chase Ultimate Rewards portal allows you to book flights, hotels, car rentals, and other travel-related expenses using your accumulated points. This can be a great way to reduce your out-of-pocket expenses when planning business trips or even personal vacations.

If you prefer cash back, the Chase Ink Business Preferred Credit Card allows you to redeem your points for statement credits. This means your rewards can be used to offset your credit card balance, effectively reducing your business expenses. Cash back can be a valuable option for businesses looking to maximize their cost savings.

For those who prefer tangible rewards, the card offers the option to redeem points for gift cards to popular retailers and brands. This allows you to treat yourself or your employees to a well-deserved shopping spree while still utilizing your rewards.

In addition to these standard redemption options, the Chase Ink Business Preferred Credit Card also allows you to transfer your points to participating frequent flyer and hotel loyalty programs. This opens up a world of possibilities for leveraging your points for even more value, such as upgrading your flights or booking luxury accommodations.

It’s important to note that the value of your points can vary depending on how you choose to redeem them. For instance, redeeming for travel through the Chase Ultimate Rewards portal may offer a higher value per point compared to cash back or gift cards. It’s worth considering the different redemption options and doing some research to determine which option provides the most value for your business.

Another great feature of the Chase Ink Business Preferred Credit Card is that there are no blackout dates or travel restrictions when it comes to redeeming your points. As long as there is availability, you can use your points to book travel at any time.

In summary, the Chase Ink Business Preferred Credit Card offers flexibility and a range of options for redeeming your rewards. Whether you prefer to use your points for travel, cash back, gift cards, or prefer to transfer them to loyalty programs, this credit card gives you the freedom to choose how to maximize the value of your points.

Travel Benefits

The Chase Ink Business Preferred Credit Card provides a variety of travel benefits that make it a popular choice for frequent travelers. These benefits can enhance your travel experience, provide peace of mind, and help save money on various travel-related expenses.

One of the standout travel benefits of this credit card is the trip cancellation and interruption insurance. If you need to cancel or interrupt a trip due to covered circumstances, such as illness or severe weather, this benefit can reimburse you for any non-refundable expenses. This can provide significant financial protection, especially when faced with unexpected travel disruptions.

Additionally, the card offers primary rental car insurance. When you use your Chase Ink Business Preferred Credit Card to pay for a rental car and decline the rental company’s insurance coverage, you are eligible for coverage against theft and damage. This can save you money on insurance fees and provide added peace of mind during your travels.

Baggage delay insurance is another valuable travel benefit offered by the Chase Ink Business Preferred Credit Card. If your checked baggage is delayed for more than a specified period, you can be reimbursed for essential purchases, such as clothing and toiletries. This benefit can be particularly helpful when your luggage is lost or delayed during your journey.

In addition to these specific travel benefits, the card also offers access to Visa Signature Concierge services. Whether you need help with travel arrangements, restaurant recommendations, or special event tickets, the concierge service is available 24/7 to assist you with your needs. This personalized assistance can enhance your travel experience and make your trips more enjoyable and stress-free.

Furthermore, as a cardholder, you have access to a variety of travel and purchase protections, including travel accident insurance, purchase protection, and extended warranty coverage. These additional benefits can provide peace of mind and help protect your business purchases while traveling.

It’s important to review the specific terms and conditions of these travel benefits, as certain limitations and exclusions may apply. Familiarize yourself with the coverage details and requirements to ensure you can take full advantage of these valuable perks.

Overall, the travel benefits offered by the Chase Ink Business Preferred Credit Card can help make your trips more enjoyable, protect you against unexpected events, and provide cost savings on travel-related expenses.

Additional Perks and Benefits

Aside from the travel benefits, the Chase Ink Business Preferred Credit Card offers additional perks and benefits that can further enhance the value and convenience of card membership.

One of the notable perks is the cell phone protection feature. By paying your monthly cell phone bill with your Chase Ink Business Preferred Credit Card, you may be eligible for reimbursement if your phone is stolen or damaged. This perk can save you money on costly repairs or replacement devices.

The card also provides purchase protection, which covers eligible new purchases against damage or theft for a specified period from the date of purchase. This can be particularly valuable for businesses that frequently make expensive purchases, offering peace of mind knowing that you’re protected if something goes wrong.

Furthermore, the extended warranty coverage extends the length of the manufacturer’s warranty on eligible purchases made with the card. This can be beneficial for businesses that invest in equipment and technology, providing extended protection on these items.

As a cardholder, you’ll have access to the Chase Ultimate Rewards portal, where you can not only redeem your points but also take advantage of exclusive deals, discounts, and special promotions. This can provide valuable savings on travel, shopping, and other experiences.

Additionally, the Chase Ink Business Preferred Credit Card offers fraud protection and zero liability for unauthorized charges, giving you peace of mind when using your card for purchases. You can feel confident knowing that you won’t be held responsible for fraudulent activity.

Other benefits include access to the Visa Signature Luxury Hotel Collection, which provides exclusive perks and upgrades at participating luxury hotels worldwide. This can add an extra touch of luxury to your business trips or personal vacations.

Last but not least, the card provides expense management tools, such as the ability to assign employees to additional cards and set individual spending limits. This can help businesses streamline their expense tracking, manage employee spending, and simplify the reimbursement process.

It’s important to review and understand the terms and limitations associated with these additional perks and benefits. Some benefits may have specific eligibility requirements or coverage limitations, so it’s crucial to familiarize yourself with the details to ensure you can fully utilize these advantages.

Overall, the Chase Ink Business Preferred Credit Card offers an array of additional perks and benefits that can enhance your card membership and provide added value and convenience for your business.

Fees and Drawbacks

While the Chase Ink Business Preferred Credit Card offers many benefits, it’s essential to consider the associated fees and potential drawbacks before applying for the card.

First, let’s talk about the annual fee. The card has an annual fee, which is a cost you need to factor into your decision. However, considering the card’s robust rewards program and valuable benefits, the annual fee can often be offset by the rewards and savings you can earn. It’s important to assess your spending patterns and rewards potential to determine if the benefits outweigh the cost.

Another fee to be aware of is the foreign transaction fee. If you frequently travel internationally or make purchases from foreign merchants, the foreign transaction fee can add additional costs to your transactions. It’s advisable to consider whether the benefits and rewards of the card outweigh this fee if you are a frequent international traveler.

Additionally, the card may have certain eligibility requirements. It is intended for businesses, so you must have a legitimate business to qualify for the card. You may be asked to provide documentation to prove your business’s existence and financial standing, which could pose a challenge for certain individuals or startups without an established business history.

Another potential drawback is that the card’s bonus rewards categories have spending caps. Once you reach the cap, the bonus rewards rate reverts to the base rate. While this may not be a significant concern for smaller businesses with moderate expenses, it can limit the rewards potential for larger businesses with higher spending requirements.

Lastly, as with any credit card, it’s important to exercise responsible spending habits and make timely payments to avoid incurring interest charges and late fees. Failure to pay off your balance in full each month can negate the value of the rewards earned and potentially lead to accumulating debt.

Before applying for the Chase Ink Business Preferred Credit Card, carefully evaluate the fees and potential drawbacks against the benefits and rewards it offers. Assess your business’s spending patterns, travel habits, and long-term goals to determine if the advantages outweigh the costs.

In summary, while the Chase Ink Business Preferred Credit Card offers an array of benefits and rewards, it’s essential to consider the associated fees and potential drawbacks. Assess your business’s specific needs and spending patterns to determine if the card aligns with your financial goals and provides a strong return on investment.

How to Apply

If you’ve decided that the Chase Ink Business Preferred Credit Card is the right fit for your business, applying for the card is a straightforward process. Here’s a step-by-step guide on how to apply:

- Visit the Chase website. Start by visiting the official Chase website to access the application page for the Chase Ink Business Preferred Credit Card. You can navigate to the business credit card section or search specifically for the card name.

- Provide your business information. The application will require you to provide detailed information about your business, including the legal name, address, industry type, and tax identification number. Be prepared with your business’s financial information, such as annual revenue and years in operation.

- Enter your personal details. In addition to business information, you will need to provide your personal details, including your name, address, social security number, and date of birth. Chase may also request information about your personal income. Ensure that the information you provide is accurate and up to date.

- Review the terms and conditions. Before submitting your application, it is crucial to review the terms and conditions associated with the Chase Ink Business Preferred Credit Card. Take the time to understand the annual fee, interest rates, rewards program, and any other important details.

- Submit your application. Once you have reviewed all the information and are ready to proceed, submit your application online through the Chase website. You will usually receive an immediate decision on your application, although in some cases, it may take a bit longer for Chase to review and approve your application.

- Wait for your card to arrive. If your application is approved, you can expect to receive your Chase Ink Business Preferred Credit Card in the mail within a few business days. Activate your card as soon as you receive it by following the instructions provided.

Keep in mind that meeting the eligibility requirements and providing accurate information are crucial for a successful application. It’s also important to note that approval is not guaranteed and is subject to Chase’s approval process, which considers factors such as creditworthiness and business history.

If you have any questions or need assistance during the application process, Chase’s customer service is available to provide support. You can easily reach out to them through their website or contact their dedicated phone line for credit card inquiries.

By following these steps and providing the necessary information, you can complete the application process for the Chase Ink Business Preferred Credit Card and set yourself on the path to enjoy its many benefits and rewards.

Conclusion

The Chase Ink Business Preferred Credit Card is a compelling choice for small business owners and entrepreneurs looking to maximize their rewards and enjoy valuable travel benefits. With its generous sign-up bonus, competitive rewards program, and flexible redemption options, this credit card offers numerous opportunities to earn and redeem valuable points.

The card’s travel benefits, such as trip cancellation and interruption insurance, rental car insurance, and baggage delay insurance, can provide peace of mind and save you money during your travels. Additionally, the various additional perks and benefits, including cell phone protection, purchase protection, and extended warranty coverage, offer added protection and convenience for your business purchases.

While there are associated fees, such as the annual fee and foreign transaction fees, the rewards and benefits often outweigh these costs. It’s crucial to evaluate your business’s spending patterns and travel habits to determine if the card’s rewards program aligns with your financial goals.

When applying for the card, ensure that you provide accurate information and review the terms and conditions. The application process is streamlined and can be done online through the official Chase website.

In conclusion, the Chase Ink Business Preferred Credit Card is a powerful tool for businesses seeking to earn rewards, simplify expense management, and access valuable travel benefits. By taking advantage of its sign-up bonus, maximizing spending in bonus categories, and utilizing the flexible redemption options, you can make the most of this credit card and enjoy the perks it has to offer.

Remember to use the card responsibly, pay your balance in full each month to avoid interest charges, and take advantage of the various features and benefits that come with the card. With careful spending and strategic redemption, the Chase Ink Business Preferred Credit Card can be a valuable asset for your business, helping you save money, earn rewards, and enhance your overall financial success.